High-Performance Single Family Development

Thank you for taking the time to review our executive summary. We are grateful for your consideration and hope you will choose to invest with us.

If you have any questions, please don’t hesitate to contact me. We look forward to the opportunity to do well while doing good together.

You can reach me by email at glenn@newenglandbldr.com or by phone at (860) 501-1547.

An investment Opportunity for Accredited Investors

Executive Summary

New England Builders & Millworks LLC (NEBM) is launching a new high-performance home development project in the Stonington, Connecticut area. We are a group of experienced designers and tradesmen who are hands-on every day, personally involved in every stage of design and construction.

With over 35 years of personal experience in real estate development and construction, NEBM specializes in designing and building custom, energy-efficient homes that meet the needs of today's discerning buyers. This project will deliver a single-family spec home featuring cutting-edge building science, sustainable construction techniques, and premium craftsmanship.

The business model is straightforward: acquire a desirable lot, construct a high-performance home using NEBM’s established systems and skilled team, and sell the completed property at a premium. Investor capital will be secured under a Regulation D 506(c) offering structure, targeting accredited individuals seeking short-term, asset-backed real estate opportunities.

Project Overview

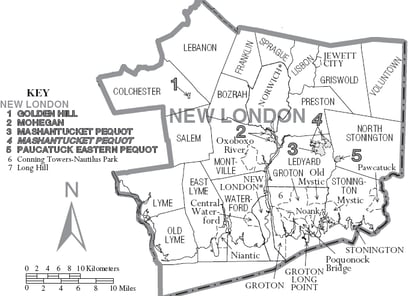

Location: Stonington, Connecticut area

Property Type: Single-family, energy-efficient spec home

Total Project Cost: $554,450 (including land acquisition)

Projected Sales Price: $625,000 – $750,000

Estimated Timeline: 10–12 months from acquisition to sale

Exit Strategy: Market and sell completed home upon completion

Market Overview

Stonington, CT is one of the most desirable residential locations in southeastern Connecticut, offering coastal charm, historic architecture, and proximity to amenities in nearby Mystic and Westerly, RI. The area has experienced steady appreciation in home values, particularly in the post-pandemic period, driven by strong demand for high-quality housing among both primary residents and second-home buyers.

Local inventory remains tight, particularly for new construction and energy-efficient homes. Buyers are increasingly drawn to properties with lower operating costs, superior indoor air quality, and sustainable building materials—features that NEBM homes are specifically designed to deliver.

Stonington benefits from access to I-95, Amtrak, and regional employers such as Electric Boat, Pfizer, and the growing tourism and hospitality sector. The local school system is highly rated, and the community offers strong appeal for families, professionals, and retirees alike. The average days on market for well-priced new homes in the area is significantly below state averages, with multiple-offer situations becoming more common in recent quarters.

Comparable Sales Analysis

Recent sales of comparable new construction and high-performance homes in the Stonington and Mystic area support the projected resale range:

14 Boulder Avenue, Stonington: 2,500 sq. ft., new construction home sold for $735,000 (closed Q1 2025)

22 Mistuxet Avenue, Mystic: 2,300 sq. ft., energy-efficient home sold for $710,000 (closed Q4 2024)

9 Elm Street, Stonington Borough: Renovated home with sustainability upgrades sold for $775,000 (closed Q1 2025)

These comps reflect strong demand for efficient, modern homes with quality finishes and sustainable features. They also reinforce the target sales range of $625,000–$750,000 for the proposed project.

North Stonington Library

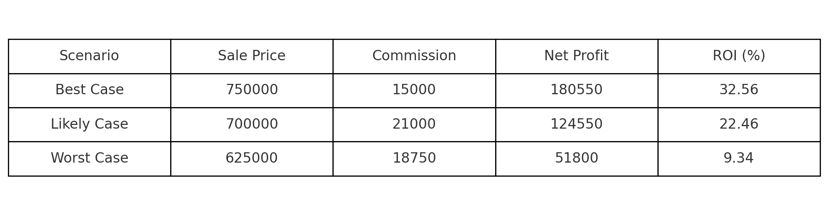

Financial Highlights

Please note: Land acquisition and construction costs reflected below are based on current estimates. Final figures will be confirmed upon site acquisition, final design selections, and contractor pricing. A contingency allowance of approximately 5–10% has been included in the budget to account for potential fluctuations in materials, labor, and permitting. Sensitivity analysis has been conducted to model outcomes under various cost and sales price scenarios, ensuring risk is evaluated conservatively. Please note: Land acquisition and construction costs reflected below are based on current estimates. Final figures will be confirmed upon site acquisition, final design selections, and contractor pricing.

Company Background

New England Builders & Millworks, LLC is a Mystic, CT-based design-build firm focused on constructing high-performance, energy-efficient homes throughout southeastern Connecticut. The company integrates durable building envelopes, encapsulated crawlspaces, Rockwool insulation, and superior indoor air quality into every project. All homes are crafted with a commitment to sustainability, aesthetics, and long-term value.

Principal Glenn Callahan brings over three decades of experience managing both residential construction and private real estate investments. NEBM operates with a hands-on, transparent approach and maintains a deep network of subcontractors, suppliers, and regional professionals.

Investment Summary

Waterfall Structure (Example)

Sample Timeline and Distribution Illustration (12-Month Investment on $25,000):

Step Description Distribution Amount

Preferred Return 8% annual return on $25,000 investment $2,000

Return of Capital Full return of investor principal $25,000

Profit Share – Investor 70% of remaining $2,750 $1,925

Profit Share – Sponsor 30% of remaining $2,750 $825

Total Distributable Proceeds: $28,925

Waterfall Summary:

Remaining profit: $18,333

Since the investor has not yet achieved a 15% IRR, the next $11,000 (approx.) is split 70% investor / 30% sponsor:

$7,700 to investor

$3,300 to sponsor

If any profit remains after the investor's IRR exceeds 15%, it would then be split 50/50.

Preferred Return: 8% annualized, paid first to investors

Return of Capital: 100% of investor capital returned before profit share

Profit Split:

First tier: 70% to investors / 30% to sponsor until investors achieve a 15% IRR

Second tier: 50% to investors / 50% to sponsor thereafter

This structure ensures investors receive a strong preferred return with aligned upside based on project performance. The Internal Rate of Return (IRR) is a time-weighted measure of an investor's total annualized return. It includes all distributions to the investor—both the preferred return and profit share—over the life of the investment. The 15% IRR hurdle includes the 8% preferred return; it is not additive. In other words, once an investor's overall return (including the 8% pref) reaches a 15% IRR, the profit-sharing structure shifts to the second tier. This ensures that investors are prioritized for early and substantial returns before profit-sharing accelerates in favor of the sponsor.

Offering Structure: 506(c) Private Placement

Minimum Investment: TBD (typically $25,000+)

Investor Security: Equity position secured by real property

Use of Funds: Land acquisition, soft costs, vertical construction

Distributions: Upon sale of the completed home

Competitive Advantage

Proven experience in high-performance home construction

Deep market knowledge of Stonington and surrounding communities

Energy-efficient building methods reduce days on market and increase sale prices

In-house design, millwork, and construction management for quality control

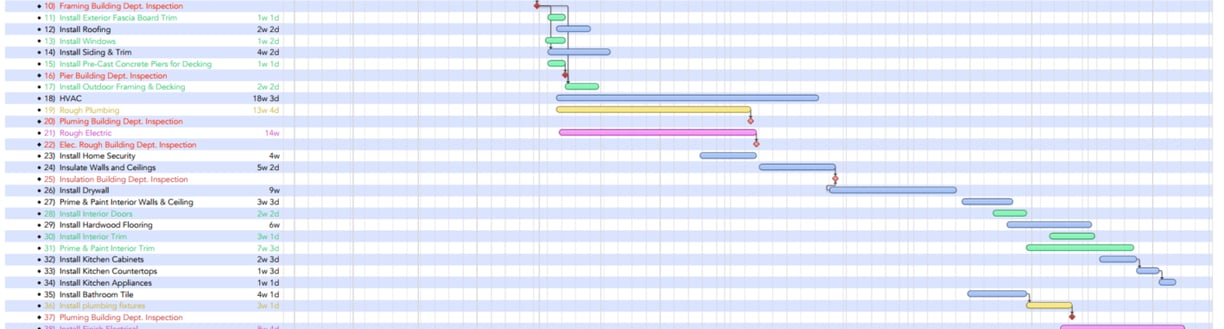

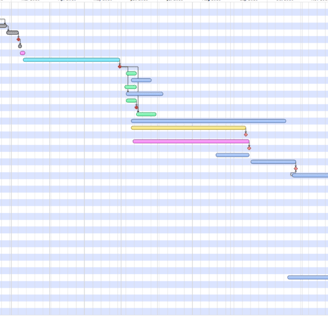

Progress Updates

New England Builders & Millworks, LLC provides investors with regular transparency and confidence throughout the build cycle. We issue weekly project updates in PDF format via email, including jobsite photos, milestone highlights, and construction progress summaries. Additionally, investors receive a monthly budget and spending report showing how project funds are being allocated, ensuring full financial transparency. Investors are always welcome to request additional information or schedule a site visit.

Next Steps

If you are an accredited investor interested in participating, please review our Operating Agreement, Private Placement Memorandum (PPM), Subscription Agreement, and detailed financial projections—all available in PDF format.

NEBM is currently accepting soft commitments to secure the land parcel and finalize construction timelines.

To schedule a call or Zoom meeting, please contact Glenn Callahan directly.

Thank you for your time and interest.

Contact:

Glenn Callahan

glenn@newenglandbldr.com

www.newenglandbldr.com

Operating Agreement, Private Placement

Private Placement

Subscription Agreement

Financial Projections